Is AppleCare+ really worth it? Apple's Coverage vs. Carrier Phone Insurance Compared

Last week, we discovered most phone upgrade programs are contracts in disguise. If consumers opt for one of the financing/upgrade plans from Sprint, Verizon or AT&T, they are forced to use service provided by that carrier as well. Meaning, these programs are a lot more like the former service contract than carriers want consumers to believe.

But if most carriers still find a way to lock customers to their service through their upgrade programs, why wouldn’t customers opt for Apple’s new iPhone Upgrade Program?

The iPhone Upgrade Program seems pretty straightforward. You sign a 24-month lease-to-buy agreement that you make monthly payments on. After you make 12 months of payments you have the option to upgrade to a new iPhone. Starting 6 months after your enrollment date you can pre-pay the remainder of your 12 months to upgrade sooner. If you opt for an upgrade you start the 24-month lease-to-buy process again. If you don’t upgrade, at the end of the 24 months (or after equivalent payments) the iPhone is yours.

Seems pretty great right? It’s simple and you’re not tied to a carrier service plan.

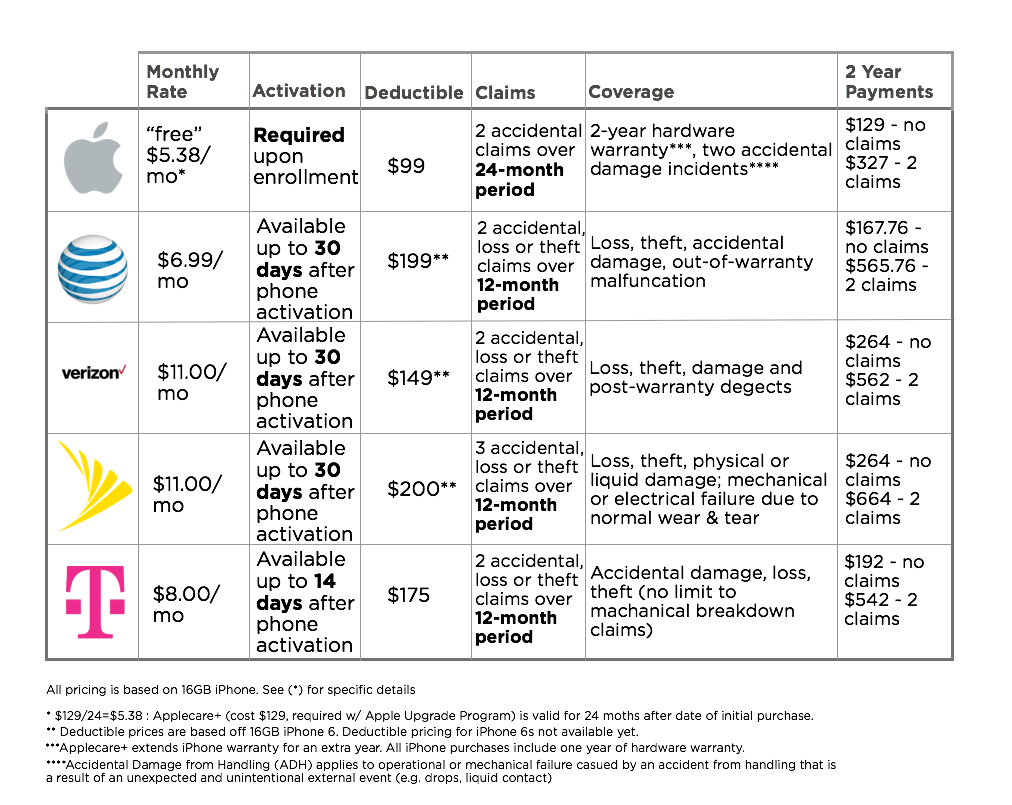

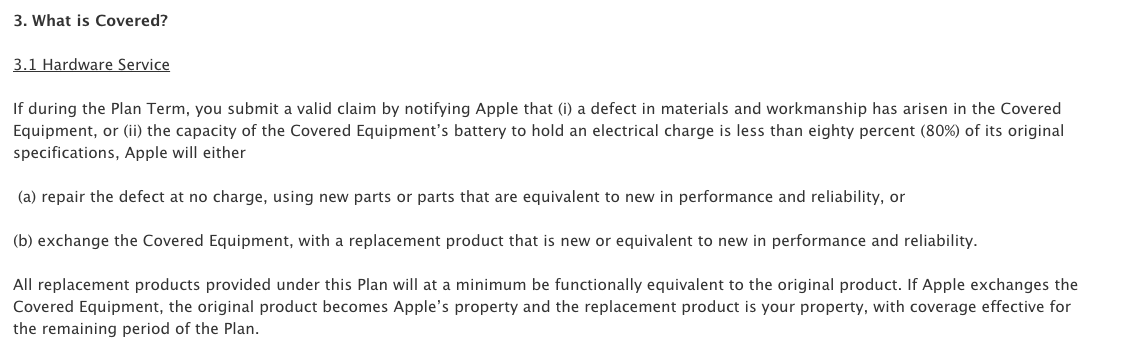

But there is a catch with Apple too. You are required to have AppleCare+, which is an extra $129 tacked on to the standard price of the iPhone.

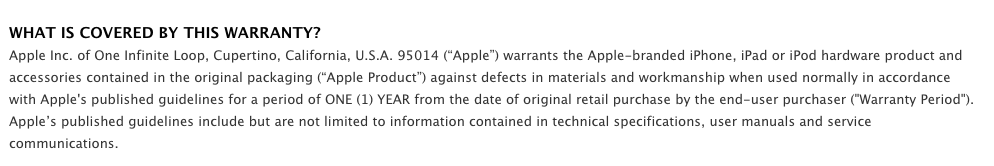

People seem to think the automatic AppleCare+ insurance is great. But is it? You already get a free year of hardware warranty and regular AppleCare technical support for 90 days with any new iPhone purchase.

And most people joining the Apple iPhone Upgrade Program will be opting for an upgrade right? A new iPhone model seems to arrive almost exactly once a year. So what extra coverage does that $64.50 customers end up paying for Applecare+ in the first 12-months of the upgrade program get them that the free standard warranty doesn’t?

Well, let’s start with the standard warranty.

Applecare+ warranty states:

Doesn’t look like much more than extra battery coverage. So it seems Applecare+ essentially gives you the same benefits as the standard warranty for an extra year. Of course, you won’t get to use that extra year if you upgrade after 12 months since you’ll be signing on for another 2 years of AppleCare+ at that point.

The other major benefit of AppleCare+ is that you can have Apple replace an accidentally damaged device up to two times, subject to a $99 deductible. But note that Apple won’t replace a lost or stolen device, so this isn’t exactly what you might expect for phone insurance. 4.5 million phones were lost or stolen in 2013, but AppleCare+ isn’t going to help when you leave your iPhone on the train or some jerk steals it.

So if you upgrade your phone every year through the iPhone Upgrade Program then is that year of Applecare+ really worth it? Yes, if you think you may accidentally break your phone, but that’s pretty much the only value on top of the normal warranty. If you’re not likely to break your iPhone, then $129 is a pretty high premium on something that has a base price tag of $649. Especially since your unused replacements for accidental damage don’t accumulate across upgrades.

If you always opt for AppleCare+ then maybe you are fine with paying the extra 20% added to the sticker price. But wouldn’t a giant Otterbox or Lifeproof case give you the majority of that assurance at a fraction of the price with no deductible?

If you want the assurance of a replacement device even in cases of loss or theft, then a carrier upgrade plan may be a better option for you. While a bit pricier than Applecare+, carrier insurance on all four major US carriers covers customers for loss and theft. Even customers looking to get financing and upgrades without insurance may be interested in carrier options, as none of the carriers require insurance with their upgrade programs as Apple does.

So while carrier insurance is more expensive compared to AppleCare+, if you’re known to be forgetful or worried about theft, the assurance of a replacement device in those cases may be worth the extra cost.

Also keep in mind that your phone may be covered under your homeowners or renters insurance. We spoke with a State Farm Insurance rep, who told us that theft of your phone is automatically covered under either policy. But beware that deductibles on most policies are typically $1000, which will mean you’re still paying out of pocket. And your insurance company won’t come to your rescue if you lose your phone either.

Ultimately, if you plan to upgrade your phone every year and you’re not concerned with accidentally damaging it, then forced-Applecare+ isn’t cost efficient. If you’re worried about breaking your phone, but not losing it, then Apple’s plan may be right. If you want coverage on theft or loss, then carriers should be your choice. Or maybe, the theft insurance you gained from your renters or homeowners policy gives you the courage to opt out of insurance entirely. There’s really no right answer.

While these financing/upgrade programs (whether from Apple or from carriers) initially seem appealing, every single one of them has a catch. The only real way to avoid the hangups is to purchase an unlocked phone at full price, which allows service freedom without insurance requirements. The sticker shock may be daunting at first. But in return for more money up front, you’ll avoid the 20% markup for AppleCare+ and you won’t be tied to a particular carrier’s service.